The best way to save your money is by investing in fixed deposits. As it will not only inspire you to save more but would also provide you with a considerable interest income. This earned interest could be paid in many options such as monthly, quarterly, half-yearly, or at maturity as per the investors choice.

All types of financial institutions..be it banks, NBFCs, and even post offices offer the facility of FD accounts. However, the FD interest rates vary for each bank, NBFC, and post office. Not only does the Post office FD interest rate vary from the highest FD interest rates in India offered by other banks and NBFCs but their features differ too.

With the help of an FD rate calculator, you can easily compare the interest rates for all the banks and NBFCs and thus make a well-informed financial decision. But still, the question arises how do you get the highest FD interest rates in India and thus get the best returns from your FD? Just read along and discover on your own.

How do you get the highest FD interest rates in India?

Your overall returns on FD is majorly dependent upon the rate of interest you get from your FD provider. So it becomes immensely important to find the best FD plan and thus enjoy higher returns owing to the highest FD interest rates in India.

However, before deciding on anything, you must do thorough research in order to compare and select the best FD plan. An FD rate calculator like that of Bajaj Finance could be of great help during this whole research process.

What is the Bajaj Finance FD rates calculator?

It is an online tool designed to ascertain the maturity amount of your FD along with the interest. It helps you know the exact returns of investment even before you start investing. Utilize the FD interest calculator and get the best returns out of your FD investment.

How to utilize the Bajaj Finance FD Calculator to get the highest FD interest rates in India?

With a very user-friendly interface, you can utilize the Bajaj Finance FD Calculator as follows:

- First, select the type of customer you are – New/ Existing customer or senior citizen

- Then enter the deposit amount, your rate of interest, and tenure

- Choose the type of deposit – Cumulative or non-cumulative

- And finally, click on the calculate button

That’s it! You now can see your exact FD returns right in front of you.

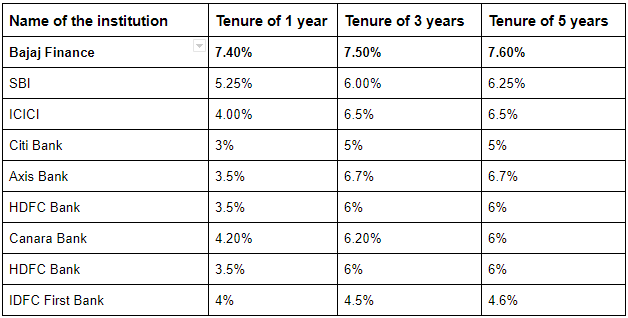

Here are 2020’s highest FD interest rates in India for your consideration.

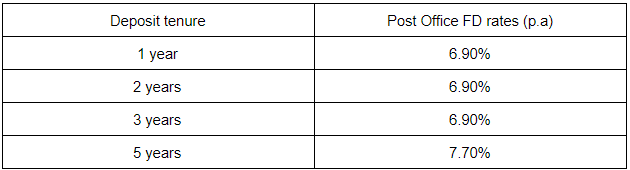

And here is a list of Post Office FD interest rates in India.

With ICRA’s MAAA (stable) rating and CRISIL’s FAAA (stable) rating, and being the only Indian NBFC with an international rating of ‘BBB’ by S&P Global, your investments with Bajaj Finance FD are never at risk.

Apart from the highest FD interest rates in India as shown in the table, Bajaj Finance FDs offer you numerous benefits such as online application of FDs, the facility of loan against fixed deposits, premature withdrawal, etc.

You can start investing in Bajaj Finance FDs with a minimum deposit of Rs. 25,000 and enjoy interest rates up to 7.85%.

Things to keep in mind to get the highest FD interest rates in India

- Invest more and more in FDs, as, the higher the FD amount, the higher the interest rate.

- Banks and other NBFCs offer fixed deposits for a term of 7 days to 10 years. In order to get the highest FD interest rates in India, you should go for a longer tenure FD.

- Existing Customers and Senior Citizens get the highest FD rates in India.

- Consider an interest regime while investing in an FD. If you think there will be a rising interest rate regime in the future (i.e. interest rates will increase in the future), then you should go for a shorter FD term. And, if the interest rate regime falls (i.e. future interest rates fall), you should invest your hard-earned money for a longer period.

- Aspirants of the highest FD interest rates in India should go for cumulative FDs as they earn higher returns in comparison to non-cumulative FDs, owing to the benefits of compounding.

All types of financial institutions..be it banks, NBFCs, and even post offices offer the facility of FD accounts. However, the FD interest rates vary for each bank, NBFC, and post office. Not only does the Post office FD interest rate varies from the highest FD interest rates in India offered by other banks and NBFCs but their features differ too. But with the help of an FD rate calculator, you can easily compare the interest rates for all the banks and NBFCs and thus make a well-informed financial decision.

Your overall returns on FD is majorly dependent upon the rate of interest you get from your FD provider. So it becomes immensely important to find the best FD plan and thus enjoy higher returns owing to the highest FD interest rates in India.

I hope all this information will help you in getting the highest FD interest rates in India.